OLAP at a Glance

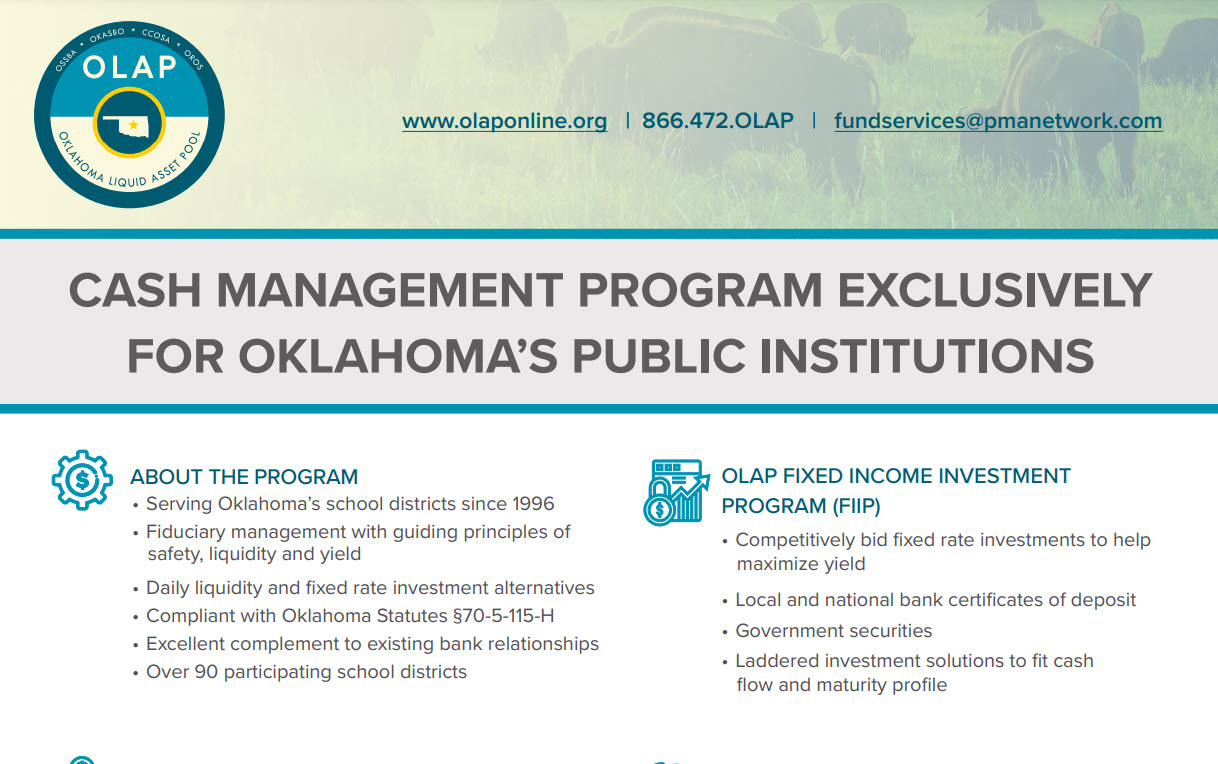

The Oklahoma Public School Investment Interlocal was organized in August of 1996 and formed the Oklahoma Liquid Asset Pool (OLAP) to enable Oklahoma public schools to conveniently and effectively invest their operating and reserve funds. OLAP’s Sponsoring Associations include the Cooperative Council of Oklahoma School Administration (CCOSA), Oklahoma State School Boards Association (OSSBA), Oklahoma Association of School Business Officials (OKASBO), and Organization of Rural Oklahoma Schools (OROS).

Rates and Performance

*Daily Rate: Refers to income generated over the previous one day period; the income is then annualized.

*7-Day Average Rate: Refers to income generated over the previous seven day period; the income is then annualized.

*7-Day Effective Rate: Calculated in the same manner but assumes reinvestment of income over the seven day period. Due to compounding, the 7-Day Effective Rate will be slightly higher than the 7-Day Average Rate.

Investment Programs

Fixed Income Investment Program (FIIP)

OLAP offers a Fixed Income Investment Program which allows Participants to individually invest monies in certificates of deposit issued by financial institutions and certain securities issued by the U.S. Government or its agencies and instrumentalities. This is a viable option for reserve funds or bond proceeds that do not require daily liquidity.

Cash Flow Management Program

The Cash Flow Management Program gives public entities a complete and accurate picture of their cash flow so they can put their money to work sooner and longer. It helps client’s feel confident that liabilities are met with a maturity, invest longer to take advantage of higher rates, plan for cash shortfalls, identify long-term investment potential and maximize interest income.

Bond Proceeds Management Program

The Bond Proceeds Management Program (BPM) is a comprehensive service that helps Participants establish a reliable and sufficient flow of funds, optimize investment earning and adequately cover projected expenses. Additionally, BPM assists public entities in the critical areas of investment, arbitrage and reporting.

Current Information

OLAP Brochure

Click the button below to view the brochure and learn more about OLAP.

VIEW OLAP BROCHURE

OLAP Newsletter

Washington D.C. Impacting Markets

Financial markets appear to be increasingly impacted by developments in Washington D.C. Fixed income and equity markets finished higher for the month despite periods of elevated volatility.

READ MORE

Knowledge Center

Click the button below to view all the latest resources in the OLAP Knowledge Center.

VIEW KNOWLEDGE CENTER

How To Join

Learn more about how to become an OLAP Participant.

Knowledge Center

Browse the library of OLAP documents, articles and more.